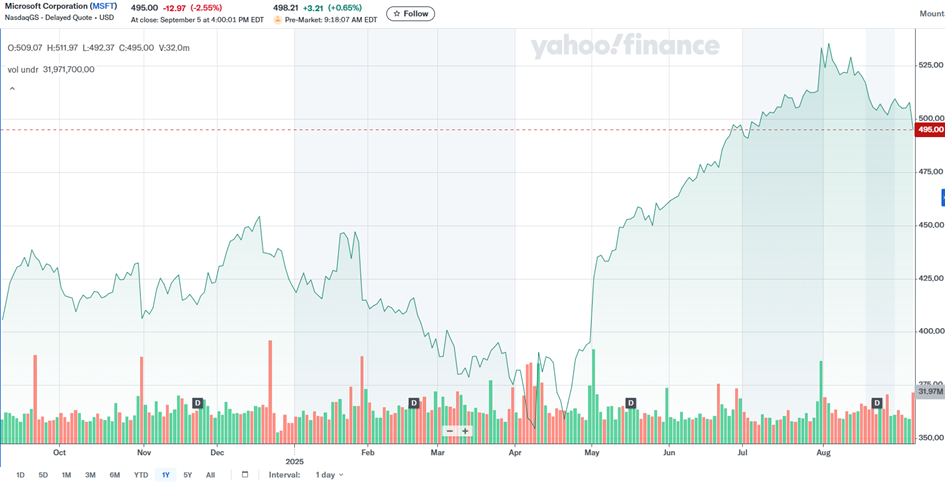

As of September 8, 2025, Microsoft (MSFT) shares are trading at $495, down approximately -0.026% from the previous day. The company’s market capitalization is nearly $2.8 trillion with a P/E ratio of 28.9, still ranking it among the world’s most valuable technology stocks.

1. Azure outages due to damage to undersea cables

Microsoft faced significant problems with its Azure cloud service due to the disruption of several undersea cable routes in the Red Sea region. The incident led to increased latency and partial outages in the Middle East, Asia, and Europe. The company has implemented alternative network traffic routing and is working with partners to restore capacity. This event highlighted the vulnerability of global internet infrastructure and the need for redundant solutions in cloud services.

2. Restructuring and layoffs in connection with the advent of AI

Like other tech giants, Microsoft has announced significant job cuts affecting thousands of employees. The restructuring reflects the advent of artificial intelligence and its impact on the automation of work processes. The company expects to increase efficiency and reduce costs, but this move has sparked debate about the social impact of AI on the labor market.

3. Strategic agreement with the US federal government

Microsoft has signed a significant agreement with the US General Services Administration (GSA) as part of the OneGov program. The package of discounts and savings worth USD 6 billion will give federal agencies access to cloud and AI services (Azure, Microsoft 365, Dynamics 365, Sentinel, etc.). Savings of around $3.1 billion are expected in the first year alone. The offer also includes one year of free access to the Copilot assistant for Microsoft 365 G5 license holders. CEO Satya Nadella described the agreement as strategically key to strengthening Microsoft’s position in the public sector.

4. Corporate culture and leadership

Satya Nadella once again emphasized the concept of a „growth mindset,” based on a „learn-it-all” approach rather than a „know-it-all” approach. This approach is intended to strengthen employee adaptability and the company’s ability to respond to rapid changes associated with AI transformation. A culture of continuous learning is presented as a key element of the company’s long-term growth.

5. Technical problems with Windows update

The August security update for Windows 10/11 caused unexpected problems: frequent UAC (User Account Control) prompts for regular users and, in some cases, application failures. Microsoft recommended a temporary workaround by running applications in administrator mode and deployed a Known Issue Rollback mechanism. The company also denied claims that the update causes SSD drives to fail, but continues to monitor the situation.

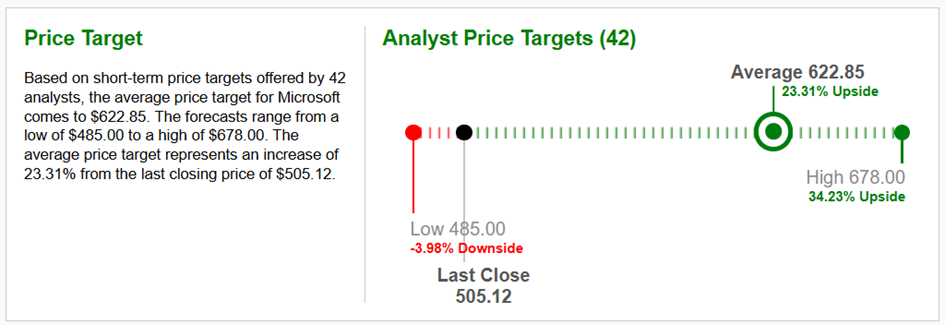

Graph Source : www.zacks.com

Conclusion:

In September 2025, Microsoft faces a combination of technical challenges, organizational changes, and strategic opportunities. On the one hand, there are short-term problems (Azure outages, difficulties with Windows updates), and on the other hand, there are significant contracts with the public sector and a long-term focus on artificial intelligence. Thanks to its high market capitalization, strong cloud infrastructure, and clear management vision, the company has the potential to continue strengthening its global position despite the current turbulence.

The company also pays regular quarterly dividends to its shareholders. The dividend yield is currently $0.83 per share. The dividend amount itself was approved by the company’s general meeting at 0.67% p.a. Analysts at Zacks.com set the average target price for the short to medium-term investment horizon at USD 622.85 per share.