Palantir Technologies Inc (NYSE:PLTR) is firmly established as a key player in the artificial intelligence and data analytics space in 2025. The company’s strong revenue growth, new strategic contracts, and technology innovations have made its stock one of the best performing stocks in the S&P 500. Recent developments demonstrate not only the strength of the business model, but also the challenges associated with valuation and market euphoria.

Financial Performance Q2 2025: Growth Beyond All Expectations

In Q2 2025, Palantir surpassed the $1 billion quarterly revenue mark for the first time in its history, representing a 48% YoY increase. Of particular note, the US commercial segment grew 93% YoY, and the US market as a whole itself strengthened 53%. These results have led to an increase in the full-year revenue outlook to USD 4.14-4.15 billion, the second positive revision this year.

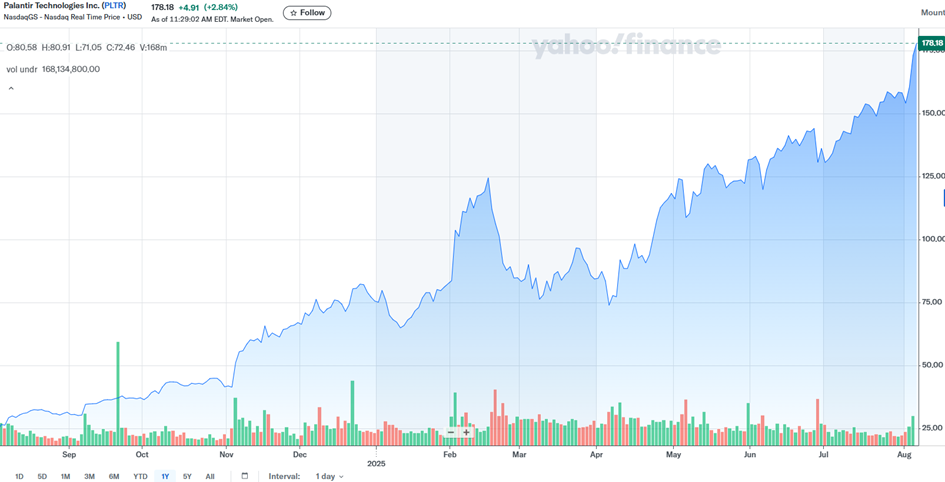

Stock market: record growth, high valuation

The market reaction was immediate. Following the release of the results, PLTR shares rallied nearly 8% in a single day, reaching a new all-time high of $179-180. The stock has added over 100% since the beginning of the year, and is on track to grow over 600% by 2022.

At the same time, however, concerns about overvaluation are rising, with forward P/Es in excess of 200 and price-to-earnings ratios at what analysts call „extreme” levels. Still, some target prices from reputable institutions (e.g. Wedbush, Citi, BofA) remain optimistic – in the range of $180-200.

Government Contracts: A Key Growth Driver

Palantir Technologies Inc (NYSE:PLTR) has significantly strengthened its presence in the public sector. In the most recent quarter, it announced the consolidation of more than 75 government contracts as part of a U.S. Army megacontract worth up to $10 billion. In addition to the defense segment, it is expanding its collaboration with organizations such as the FDA, CDC, Department of Homeland Security and others.

This contract pipeline not only diversifies revenue but also increases long-term cash flow predictability, which is key for investors.

Culture and Leadership: an alternative to the elite world of Silicon Valley

CEO Alex Karp emphasized the shift in corporate culture towards meritocracy during the results conference. He criticized the tech industry’s dependence on elite universities and introduced the Palantir Meritocracy Fellowship, a program aimed at finding talent regardless of academic background.

This initiative represents a strategic step to expand the job pool while resonating with the broader societal debate on the availability of technology professions.

Internal Transactions and Capital Management

In recent days, Board Member Alexander Moore announced the sale of approximately 20,000 shares of stock with a total value of over $3 million. The transaction took place under the 10b5-1 plan of 2024 and does not mimic a negative outlook, although similar sales are closely watched by investors.

Conclusion and Outlook

Palantir Technologies Inc (NYSE:PLTR) entered 2025 as an established leader in the AI and government analytics space. The combination of strong growth, significant contracts, and cultural transformation makes the company a unique title in the stock market. At the same time, high valuations and market volatility require investors to exercise caution and rigorous analysis.

For long-term investors with a higher tolerance for risk, Palantir represents a potentially attractive growth opportunity – especially if it can maintain its current pace of expansion while beginning to improve margins and profitability.