Amazon reported financial results for Q4 and fiscal year 2023. Progress at Amazon last year was primarily in improving customer service, continued innovation, reducing cost to serve, and investing in future growth. Amazon’s profits grew sharply. The world’s largest retailer generated revenue of $170 billion for the fourth quarter of 2023, up 14% from the same period in 2022, beating the expectations of Wall Street Journal analysts, who estimated around $166 billion. Net income for the fourth quarter was $10.6 billion. This increase was due to the company’s extensive restructuring, where the company decided to cut costs and draw a line under years of rapid expansion after the pandemic outbreak, but also due to strong growth in cloud computing and a $100 billion increase in « AWS (Amazon Web Services) » sales thanks to Gen AI artificial intelligence. The company also launched an AI-powered shopping assistant, Rufus, in its mobile app. The company’s revenue for fiscal year 2023 increased 12% to $574.8 billion compared to $514.0 billion in the previous year.

Amazon CEO Andy Jassy said: « This Q4 was a record-breaking quarter in Christmas shopping, capping off a successful year for Amazon in 2023. While we made meaningful progress in revenue, operating income and free cash flow, we are most excited about the continued reinvention and improvement of customer support for our businesses. »

The company employs around 1,600,000 tribal workers and last year it began layoffs, laying off 27,000 tribal workers. The move was mainly because the company is dealing with the impact of the Covid-19 pandemic. Recruitment has increased during that time as more customers have turned to online services for their needs. However, the demand for these services is now declining.

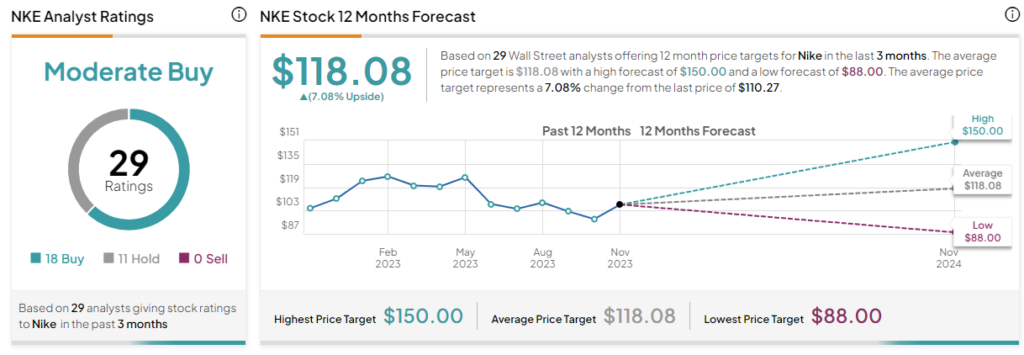

Graph Source : www.tipranks.com

23 Wall Street brokers raised their price targets on the stock as the online retail giant posted a 14% increase in sales in the holiday quarter, pointing to strong spending despite a tight economy. The average price target was set by the multinational investment corporations for the short- to medium-term investment horizon at $207.72 per share.