Western Digital (NASDAQ: WDC) is one of the most prominent stocks in the technology sector in 2025. The manufacturer of memory devices and data storage solutions is benefiting from growing demand for cloud and artificial intelligence solutions. As a result, the company’s shares have seen extraordinary growth over the past year, attracting the attention of investors and analysts alike.

Financial results and segment development

In the second quarter of fiscal year 2025, the company achieved revenues of USD 4.29 billion, representing a year-on-year increase of 41% and quarter-on-quarter growth of approximately 5%.

• The cloud segment, which accounts for more than half of revenues, was the main driver of growth and continues to strengthen its role in the company’s business model.

• The Client segment saw slight year-on-year growth but declined compared to the previous quarter.

• The Consumer segment showed improvement compared to the previous quarter but remains weaker year-on-year.

Technological development and strategy

Western Digital is building on its technology roadmap, which includes, for example, the introduction of HAMR (Heat Assisted Magnetic Recording) technology to increase hard drive capacity. The company is positioning itself as a key infrastructure provider for the AI-Data Cycle, i.e., the processing and storage of huge volumes of data generated by artificial intelligence and data centers.

Price increases in the HDD segment and stable demand for enterprise solutions are supporting margin growth. The company is also renewing its flash memory offering to strengthen its position in competition with companies such as Seagate and SSD manufacturers.

Analyst ratings and outlook

Some analysts describe WDC as an attractive growth opportunity with a relatively low forward P/E of around 12–13. Morgan Stanley has included the company among its «Top Picks,» highlighting long-term contracts and orders that provide visibility into the second half of 2026. Optimism is also supported by the fact that Western Digital shares are among the best performers in the technology sector in 2025.

Share performance

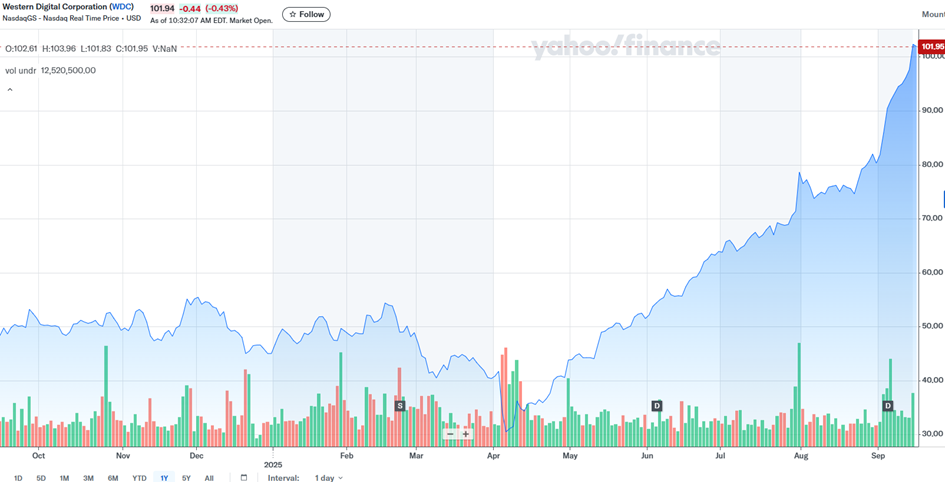

Western Digital shares are currently trading at around $102, which is close to their 52-week high ($103.78). The minimum price over the last 12 months was approximately $28.83, meaning that the stock has more than tripled in value. Since the beginning of 2025, the stock has gained more than 120%, making it one of the leaders on the US stock market.